Chipped tile claims are under assault by Florida insurance companies. Indeed, South Florida insurance companies have seen a steady rise over the years in the increased number of chipped tile claims. As a result, insurance companies are fighting back. Insurance companies are denying more and more of these claims every day. When they are not denying these claims, they are often quicker to exercise their right to repair, which triggers different contractual obligations between the parties. Citizens was even able to modify its policies to have a $10,000 cap for cosmetic or aesthetic damage to flooring, including, but not limited to, chips, scratches, dents, marring or any other damage that covers less than 5% of the total floor surface area of the building and does not prevent typical use of the floor.

Chipped tile claims are under assault by Florida insurance companies. Indeed, South Florida insurance companies have seen a steady rise over the years in the increased number of chipped tile claims. As a result, insurance companies are fighting back. Insurance companies are denying more and more of these claims every day. When they are not denying these claims, they are often quicker to exercise their right to repair, which triggers different contractual obligations between the parties. Citizens was even able to modify its policies to have a $10,000 cap for cosmetic or aesthetic damage to flooring, including, but not limited to, chips, scratches, dents, marring or any other damage that covers less than 5% of the total floor surface area of the building and does not prevent typical use of the floor.

But a recent ruling by the Fourth District Court of Appeal in Benjamin Ergas’s legal saga against his insurance company, Universal, an insurance company that was fined millions of dollars for poor claims handling, is potentially catastrophic for property owners seeking insurance coverage for damage to their floor from a sudden and accidental loss.

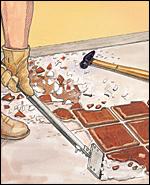

As with most cases, Benjamin Ergas’s legal odyssey started inconspicuously. Benjamin Ergas, the insured, dropped a hammer on his tile floor, causing it to chip. The chip was about the size of the hammer head. He filed a claim for the damage with Universal, his homeowner’s insurance company. Universal denied the claim. They denied the claim on grounds that the policy excluded coverage as follows:

“We insure against risk of direct loss to property… We do not insure, however, for loss: . . . 2. Caused by: . . . (e) Any of the following: (1) Wear and tear, marring, deterioration . . . .”

The insured then filed a lawsuit against his insurance company, Universal, seeking coverage for his damaged floor. The trial court, however, entered summary judgment in the insurance company’s favor. In so doing, the trial court agreed with the insurance company that the damage was excluded under the insurance policy because “marring” was not covered. The insured then challenged that ruling by filing an appeal with the Fourth District Court of Appeal.

—–

EXTENDED BODY:

On appeal, the insured argued that the term “marring” was ambiguous because the policy did not define the term. Long standing Florida law states that any ambiguity in an insurance policy should be interpreted in the insured’s favor, and coverage afforded. The insured also argued that under the doctrine of ejusdem generis, the term “marring” should be read in context. Since “marring” was found in the policy between the terms “wear and tear” and “deterioration” it suggests that marring was intended to refer to damage which was caused over time. Since the damage from the dropped hammer was sudden, the insured argued it was covered under the insurance policy, and not excluded by the “marring” exclusion.

However, the Fourth District Court of Appeal was not persuaded by those arguments. As a result, the appellate court concluded that the “the damage caused by the hammer dropping constituted marring and thus was excluded from policy coverage.” In sum, they affirmed the trial court’s conclusion to deny coverage.

The appellate court’s ruling, however, completely dismisses the sudden and accidental concept of damage. Indeed, and in dismissing that notion, the ruling does go to great lengths, in a footnote, to mention that the insured’s attorney did not argue that the insurance company’s interpretation of marring could potentially cover almost all damage to the insured’s property, whether slight or substantial. In other words, while the court noted that the term was not ambiguous, it suggested that term could very well be overbroad. And that could potentially be problematic since the overbroad use of the term of “marring” could pertain to most of what an insured would expect the policy to cover. Simply put, a definition of “mar” or “marring” which included serious injury would essentially gut coverage under the insurance policy. And the court noted that a term used within the insurance policy should not be construed to reach such an absurd result as potentially gutting all available insurance coverage under the policy. Gen Star Indem. Co. v. W. Fla. Village, Inc., 874 So.2d 26 (Fla. 2d DCA 2004).

On the other hand, since the insured’s attorney did not argue that the definition of marring is ambiguous because that term, as used by the insurance company in this case, is potentially overreaching, overbroad, and ambiguously over-inclusive of damage, the appellate court did not address that concern that they themselves noted could be very problematic for insurance companies.

Therefore, it is possible that if the appellate court is confronted with an argument that the term “marring” is ambiguous because of its potentially over-inclusive interpretation gutting just about all other available coverage that the appellate court may reach a different conclusion than the one reached in Ergas.

But until then, insurance companies will no doubt rely on Ergas to deny many “chipped tile” claims that were the direct result of a “sudden” and “accidental” event that was once covered and paid by the insurance companies.

Consider Your Options. Contact Us Today.

Before opening our law firm in 2006, our attorneys worked for some of the state’s, and nation’s, largest law firms, and worked representing the insurance companies for years. Our attorneys are now uniquely positioned to use that experience to assist individuals and businesses alike throughout Florida with their insurance claims. As a result, our attorneys are well versed in the impact insurance has on businesses, condominiums, and individuals alike. Our insurance litigation practice group is prepared to tackle your insurance claim.

Given our extensive experience litigating for, and against, insurance companies, our insurance litigation practice group is prepared to provide aggressive, efficient and effective representation on a broad spectrum of insurance claims in Florida for local, national, and international clients. We are prepared to advocate insurance claims at the pre-suit stage, trial, appellate and arbitration levels.

If you are facing a dispute over an insurance claim in Florida, contact Alvarez & Barbara, LLP, for a free and confidential consultation to discuss your rights.

Call us today toll free at 1-866-518-2913 or at 305-263-7700.