A Florida appellate court recently concluded an Insurance Company’s coverage defense had been waived because the insurance company waited too long to assert them.

A Florida appellate court recently concluded an Insurance Company’s coverage defense had been waived because the insurance company waited too long to assert them.

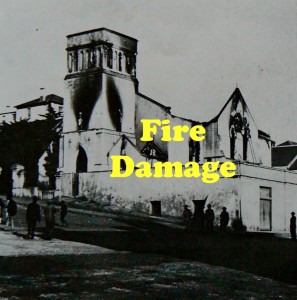

Axis Surplus Insurance Company vs. Caribbean Beach Club Association, Inc., 2014 WL 2900930, (2nd DCA 2014), involved a fire loss. In April of 2003, a fire swept through the time share condominium in Ft. Myers Beach causing extensive damage to the property. The insured had purchased an insurance policy that included coverage for fire damage. The insured had also purchased Law and Ordinance coverage for an additional premium.

The insured made a claim for fire damage. Both the insurance company and the insured knew that Lee County might enforce the “50% rule” contained in its ordinances. The 50% rule mandates that if a building is more than 50% damaged, any reconstruction or repair must comply with current building codes. If Lee County enforced the 50% rule, the insured would have to raise the entire building to meet existing flood elevation requirements.

Both the insurance company and the insured cooperated in a common goal of repairing, not replacing, the damaged building; they tried to convince Lee County not to enforce the 50% rule. Unfortunately, in November 2004, some nineteen months after the fire, Lee County informed both the insurance company and the insured that it would enforce the 50% rule. Therefore, the insured would be required to replace its building to satisfy current flood elevation codes.

After receipt of this news, the insured continued to cooperate with the insurance company. But things changed some 19 months later when the insurance company, for the first time, informed the insured that it would rely on the two year clause in the Law and Ordinance Coverage endorsement to deny payment for the increased construction cost because the replacement was not completed. Except for the general, non-specific, reservation of rights letter, the insurance company had never raised the two year clause previously with its insured.

Litigation between the insurance company and the insured followed. The trial court granted summary judgment in the insured’s favor, and an appeal followed. On appeal, the appellate court sided with the insured. In so doing, the appellate court reasoned that the insurance company waited too long to assert the coverage defense.

The Appellate court concluded that the insurance company’s conduct had in fact waived the coverage defense it attempted to assert later. It noted that that if an insurance company intends to rely on a reservation of rights, that it should specifically inform the insured of all the valid coverage defenses as soon as practicable. In this instance, the insurance company simply waited too long. In this case, the insurance company’s failure to bring the coverage defense to the insured’s attention, even though the insured expected the entire claim to be paid and the insurance company continued to adjust the entire claim after the two-year expiration, were unequivocal acts inconsistent with invoking the forfeiture. In other words, when an insurance company acquiesces to an insured’s failure to strictly adhere to a timetable of payment or performance, courts are inhospitable to the insurer’s sudden invocation of strict enforcement of forfeiture provisions.