We’ve been discussing the coming insurance rate hikes the past few weeks on this blog. The news tells us that the hikes are due to legislative changes and increased scrutiny over sinkhole claims. Also, insurers would like to make coastal property owners take on more of a financial burden due to their increased risks. Now, we may also thank a computer for the coming hikes as well.

We’ve been discussing the coming insurance rate hikes the past few weeks on this blog. The news tells us that the hikes are due to legislative changes and increased scrutiny over sinkhole claims. Also, insurers would like to make coastal property owners take on more of a financial burden due to their increased risks. Now, we may also thank a computer for the coming hikes as well.

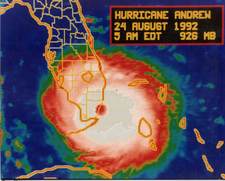

A new computer model showing the possible risks of a hurricane demonstrates that the storms may cause more damage than previously expected, especially further inland. The model was created by Risk Management Solutions, a producer of hurricane computer models used by insurers to set rates.

The belief is that hurricanes break up after reaching land. However, the model shows it could take longer for that to happen. This has the effect of increasing damage projections inland. This is the company’s first update of the model since 2003 and that there have been significant improvements in research since then. Hurricane Charley was closely examined and used to justify the model’s findings. In 2005, Hurricane Charley caused damage as far inland as Orlando.

The Florida Consumer Action Network (FCAN) believes insurance companies will use the model to justify property rate hikes. An executive from Standard and Poors agreed with this assessment. FCAN does not trust the findings and believes the model’s data does not have to be justified publicly because the data is allowed to remain confidential.

Despite FCAN’s position, its reported that the Florida Commission on Hurricane Loss Projection Methodology has access to that data. Further, this panel is supposed to review the model before it is approved for use by insurers.

—–

EXTENDED BODY:

Consider Your Options. Contact Us Today.

Before opening our law firm in 2006, our attorneys worked for some of the state’s, and nation’s, largest law firms, and worked representing the insurance companies for years. Our attorneys are now uniquely positioned to use that experience to assist individuals and businesses alike throughout Florida with their insurance claims. As a result, our attorneys are well versed in the impact insurance has on businesses, condominiums, and individuals alike. Our insurance litigation practice group is prepared to tackle your insurance claim.

Given our extensive experience litigating for, and against, insurance companies, our insurance litigation practice group is prepared to provide aggressive, efficient and effective representation on a broad spectrum of insurance claims in Florida for local, national, and international clients. We are prepared to advocate insurance claims at the pre-suit stage, trial, appellate and arbitration levels.

If you are facing a dispute over an insurance claim in Florida, contact Alvarez & Barbara, LLP for a free and confidential consultation to discuss your rights.

Call us today toll free at 1-866-518-2913 or at 305-263-7700.