Citizens Property Insurance is aggressively downsizing, which has caused many smaller insurers to take on their policies. They have been downsizing because Gov. Scott believes they need to lower risks. To the average person this seems like a good thing as smaller companies will continue to grow. However, the smaller insurers’ success when taking over the insurance policies from Citizens has proved otherwise. The companies who receive these policies from Citizens are considered to be “Takeout” firms.

Citizens Property Insurance is aggressively downsizing, which has caused many smaller insurers to take on their policies. They have been downsizing because Gov. Scott believes they need to lower risks. To the average person this seems like a good thing as smaller companies will continue to grow. However, the smaller insurers’ success when taking over the insurance policies from Citizens has proved otherwise. The companies who receive these policies from Citizens are considered to be “Takeout” firms.

Takeout firms receive policies from Citizens usually in agreement to receive money along with the policies. Once the policies are removed from citizens then the policy holder’s agent is notified of an offer to accept the takeout deal. If the agent denies the offer then the same offer will be made to the policy holder, who may refuse to allow the policy to be removed from Citizens.

What does all of this mean? Basically Citizens is paying lots of money to relatively new and small insurers who are not always equipped enough to handle this quantity of policies. This is why it is incumbent upon all Florida policy holders to check the financial strength of their insurance company.

For instance, Citizens agreed to pay Heritage Property and Casual Insurance, a nine month old company, $52 million to take over 60,000 policies. As a result of this homeowners will receive letters from Heritage and have 30 days to opt out before they are automatically removed from Citizens.

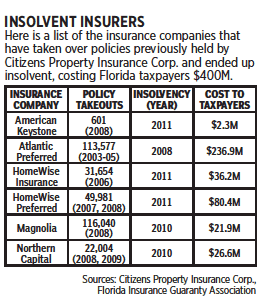

Many believe that companies such as Heritage are not capable of taking on such policies, especially in the event of a hurricane. There is evidence to back this belief as many companies who have taken over policies from Citizens have become insolvent.

The negative effective of these companies becoming insolvent is tax payers coming out of pocket for more then $400 million. This is not a good sign as Citizens is starting to intensify its effort to turn over policies to smaller insurers.

It seems as though Citizens intended purpose of lowering risk by removing these policies is actually causing more risk as smaller firms are becoming insolvent and tax payers are taking on the cost.