It is vital for every business owner or professional to have a disaster plan in place that includes knowing how to assess damage, understanding how to properly file an insurance claim, and make the required repairs to get back to work as quickly as possible. Taking the wrong approach, or simply mishandling your potential insurance claim, could cost you a lot of money with respect to any claim that may ultimately be submitted to your insurance company.

It is vital for every business owner or professional to have a disaster plan in place that includes knowing how to assess damage, understanding how to properly file an insurance claim, and make the required repairs to get back to work as quickly as possible. Taking the wrong approach, or simply mishandling your potential insurance claim, could cost you a lot of money with respect to any claim that may ultimately be submitted to your insurance company.

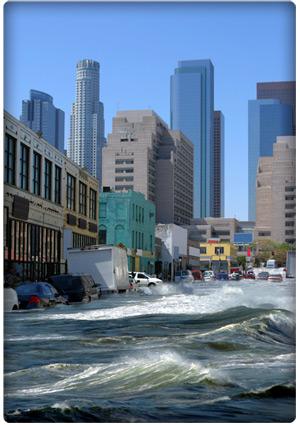

In an effort to aid your hurricane season preparation, here are some suggestions that could assist you during this upcoming hurricane season’s adequately prepare.

• Make sure to copy and safely store your pertinent documents. For instance, make sure you have a copy of your property and casualty, as well as a copy of your business interruption insurance policy, and a copy of your lease agreement. You should maintain hard copies of these important documents in the event of a long-term power outage, but you should also store these documents digitally and off-site in a secure electronic environment. You should also safely store these documents in a manner that will allow you to gain very quick access to them in the event of a catastrophe.

• You should also safely make the appropriate arrangements to have copies of your last four years of income tax returns, and the last six months of your profit and loss statements safely secured. You’ll need the financial data in the event that you have to make a business interruption claim, and you will need physical copies of these documents should you not be able to gain access to them electronically.

• Keep an updated account of your inventory, and print that out as well. Be sure to inventory all of your office supplies such as computers, desk, chairs and paper since you can recover those losses. You should photograph all of these items as well.

• If you rent space, then it is imperative that you keep a copy of your lease agreement in a safe place along with all of the aforementioned other documents.

• Make sure to take photographs and/or video of your entire workspace, including your inventory and office supplies.

• Make sure to collect emergency contact information for all of your employees, suppliers, and vendors.

• Work with your senior staff to prepare a plan for a storm, fire, flood or other emergency. What are the contingencies that will allow you to get back to work quickly, and what are the variables that will prompt a long term shut down. Who will be in charge of getting your network back up? Who will be in charge of contacting your major clients? Who will be in charge of handling your insurance claim? Assigning these responsibilities in a calm environment prior to a storm striking will only aid the smooth transition to get back to work after a storm strikes South Florida.

• If you own the property, hire a licensed inspector or contractor to examine the roof, interior and other structural components in advance to the store. You do not want the insurance company to deny your claim by saying that your property had pre-existing damage. The best way to combat that argument is to conduct the appropriate inspection today.

• Prepare a list of preferred contractors that you can call on for all necessary repairs. Don’t wait for the insurance company to find someone. If the storm was a catastrophe, then that aid will be difficult to come by. Indeed, it will be incumbent upon you to repair your damages, and the best way to do that is to contact a contractor today and make arrangements to insure prompt repairs after a storm strikes out Florida.

• Communication is vital to any recovery. Make sure you have a plan for proper communication and one should anticipate disruptions in communications services, possibly for extended periods of time.

—–

EXTENDED BODY:

Consider Your Options. Call Us Today.

Considering the increased odds of South Florida getting hit by a storm you should take the necessary steps to safeguard your property and business. That is particularly true since history suggests that South Florida is due for a hurricane strike. Therefore, this is certainly not the season to take lightly. We’ve been spared the last few years, but this could be the year where we are hit by another hurricane. Hurricanes are a fact of life living in South Florida. Although inevitable, they are not surprises like earthquakes or tsunamis. You can prepare and be ready for a hurricane. Call us today to discuss your hurricane preparation in greater detail.